WHY HKLM

EXCHANGE

Experienced,

senior team

with can do

attitude

A 17-year trck

record of multiple

award-winning

projects

A focus on reputation

building through

ecient and

creative stkeholder

communiction

HKLM

EXCHANGE

is a strategic

stakeholder

communication

advisory firm

WHY HKLM EXCHANGE / 1

• Accr, hn

• Addis Abb, Ethiopi

• pe Town, South Afric

• brone, Botswn

• Johnnesburg, South Afric

• Lgos, Nigeri

• Mseru, Lesotho

• Mbbne, Eswtini

• Nirobi, Keny

• Austrli

• Austri

• Bhrin

• Benin Republic

• Botswn

• meroon

• nd

• hin

• Egypt

• Eswtini

• Ethiopi

• ermny

• hn

• ndi

• Keny

• Kuwit

• Lesotho

• Liby

• Mlwi

• Muritius

• Mozmbiue

• Nmibi

• Nigeri

• Pnm

• Qtr

• Russi

• Sudi Arbi

• Seychelles

• South Afric

• Switzerlnd

• Tnzni

• Ugnd

• United Arb

Emirtes

• United Kingdom

• United Sttes

• mbi

• imbbwe

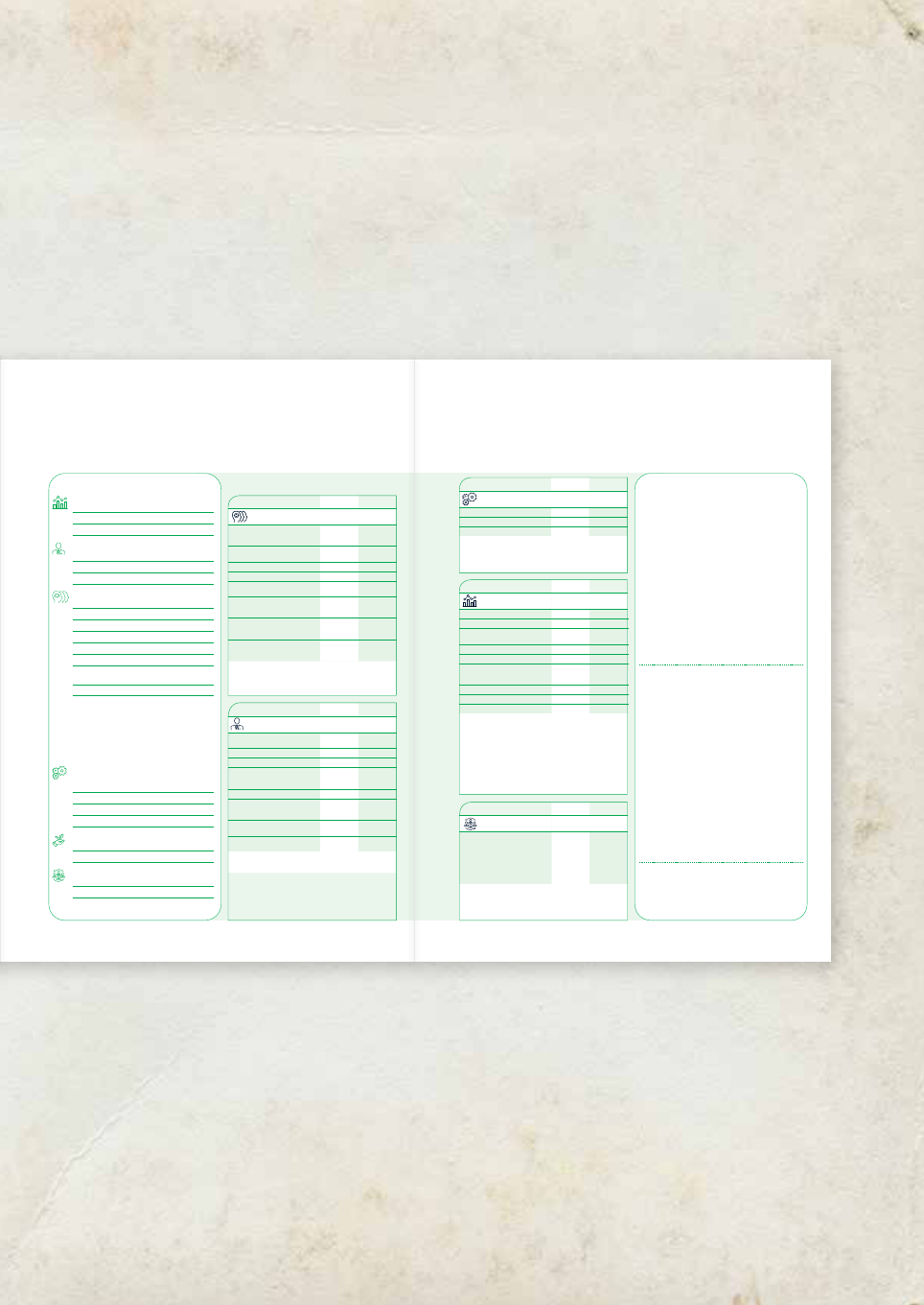

REPRESENTATION

FOOTPRINT

2 / HKLM EXCHANGE

WHERE WE ARE

Cape Town

Maseru

Johannesburg

Accra

Mbabane

Addis Ababa

Nairobi

Lagos

Gaborone

WHY HKLM EXCHANGE / 3

4 / HKLM EXCHANGE

WHAT

WE DO

HKLM

EXCHANGE

is a strategic

stakeholder

communication

advisory firm

4 / HKLM EXCHANGE

WHAT WE DO / 5

6 / HKLM EXCHANGE

* HKLM Exchange is licenced by Relational Analytics Limited to oer Relational Proximity® services in Africa.

6 / HKLM EXCHANGE

• nvestor reltions

• Reputtion mngement

• Stkeholder enggement

• risis communiction

• Strtegic communiction

• Employee/internl

communiction

• Reltionl Anlytics

TM

*

• Stkeholder

perception

surveys

• Event mngement

COMMUNICATION,

PUBLIC RELATIONS AND

POSITIONING

• Report ssessments

nd gp nlysis

• Strtegic dvice nd

best prctice

• Reporting regultions

• opywriting nd content

development

• nformtion design

INTEGRATED

REPORTING

<IR><IR>

• Report ssessments

nd gp nlysis

• Reporting strtegy

• ontent development

• Stkeholder enggement

• Review nd

benchmrking

SUSTAINABILITY

REPORTING

• Socil converstions

• Online nd digitl stkeholder

communiction

DIGITAL

• Brnd strtegy

• orporte identity

• Mrketing communiction

• Employee enggement

BRANDING

ADVISORY

WHAT WE D0 (continued)

* HKLM Exchange is a Tier 1 Workiva partner. Workiva Inc, the leading cloud provider of connected data, reporting and

compliance solutions, is used by thousands of enterprises across 180 countries, including more than 75% of Fortune 500®

companies, and by government agencies. Our customers have linked over five billion data elements to trust their data,

reduce risk and save time. For more information about Workiva (NYSE: WK), please visit www.workiva.com.

Workiva and Wdesk are registered trademarks of Workiva Inc.

• ntegrted reports

• Sustinbility reports

• Results nnouncements

nd nlyst

presenttions

• irculrs

• orporte brochures

• Environmentl grphics

• orporte identity

mnuls

• Promotionl mteril

• nternl communiction

collterl

PRINT

• App-bsed reports

• Wdesk nd other

Workiv solutions*

• SENS conversion

• Web-bsed reports

• Websites

• Digitl bord pcks

• Digitl cmpigns

cross socil medi

• PowerPoint

presenttions

• orporte videos

• XBRL

DIGITAL

• Advertising nd

opinion pieces

• Finncil dvertising

nd medi plcement

MEDIA

WHAT WE DO / 7

REPORTING AND PUBLISHING

LAYOUTPROFESSONAL PROOFREADN

PROOF HEKNDESN & PHOTORAPHYPROJET MANAEMENT

8 / HKLM EXCHANGE

PROCESSES – ADVISORY

REPORT

DESN OMMENES

DESN S UDED BY

REPORT COPY

DETAILED BREFN SESSON IN-DEPTH RESEARH

FRST DRAFT

OF REPORT COPY

LENT REVEWS AND

OMMENTS ON COPY DRAFTS

COPY CHANGES MPLEMENTED

WHAT WE D0 (continued)

REVEW OF ONTENT

PROVIDED BY CLIENT

NTERVEWS WITH

KEY EXECUTIVES

COPY APPROVED

8 / HKLM EXCHANGE

MMERSON SESSON WITH

SENIOR CLIENT TEAM

WHAT WE DO / 9

AP ANALYSS/RTQUE

OF PREVIOUS REPORT

PRESENTATON OF AP

ANALYSS/RTQUE TO CLIENT

PRESENTATION OF SUGGESTED

CONTENT STRUCTURE

DESIGN BRIEF

FROM CLIENT

DESIGN

PRESENTATION

DESN

TWEAKS

DESN

APPROVED

PRODUCTION PHASE

10 / HKLM EXCHANGE

PROJET MANAER

Manages and coordinates project phases from initial brief to delivery of final product

TMN S DEPENDENT ON THE NUMBER OF PAES AND THE NTENSTY OF THE HANES

PROOFREADER’S MARKED-UP PROOF AND INTERNAL CHANGES SENT TO CLIENT

FOR APPROVAL BEFORE IMPLEMENTATION

PROCESSES – PRODUCTION

LENT: SUBMTS OPY FOR TYPESETTN/LAYOUT

(Excel or Word format)

PROOF (INITIAL SET)

TYPESETTN/MPLEMENTATON

COPY CHANGES AND REFLOW

LENT: SUBMTS ONE OLLATED MARKED-UP HARD OPY PROOF

(Version control for submission)

PROOF (AUTHORS)

ABOVE PROESS S REPEATED UNTL SEOND LAST PROOF, WHH S

SENT TO A PROOFREADER FOR A QUALTY ONTROL READ

TYPESETTN/MPLEMENTATON

SETTING OF THE RAW COPY/GRAPHS

DELVERY OF PRNTED PRODUT

ON MUTUALLY AREED DATE

PRESS HEKS CONDUCTED

DURING PRINTING PROCESS

WHAT WE D0 (continued)

PROOF To client with proof number, time stamp and typesetter name

PROOF 2 To client with proof number, time stamp and typesetter name

10 / HKLM EXCHANGE

Repeat process

STRT FLE NAMN ONVENTONS ARE APPLED PER PROOF, DEPENDN ON PHASE N PRODUTON

(For example dropping in of new copy, plotting new graphs,

extensive redesign of diagrams and intensive author’s corrections)

WHAT WE DO / 11

DESN/LAYOUT

APPLY DESIGN CHANGES TO

DIAGRAMS/IMAGES/LAYOUTS

LENT: SUBMTS OPY FOR TYPESETTN/LAYOUT

(Excel or Word format)

LENT: SUBMTS ONE OLLATED MARKED-UP HARD OPY PROOF

(Version control for submission)

DESN/LAYOUT

APPLY DESIGN LOOK AND FEEL

TO DIAGRAMS/LAYOUTS

Proofreader notes inconsistencies, errors and recommendations

Internal quality control also occurs

APPROVED QUALITY CONTROL CHANGES

ARE IMPLEMENTED THEN FNAL PROOF

SENT TO LENT FOR FNAL SN OFF

SNED OFF PROOF PREPARED FOR

PRNT THEN SENT TO PRNTER

PRINTER’S PLOT REVEWED AND APPROVED

BY HKLM AND CLIENT PRIOR TO PRINTING

PROOF HEKN

AGAINST APPROVED STYLESHEET

+ COPY FROM CLIENT

PROOFREADN

AGAINST ONE HARD COPY

FROM CLIENT

Repeat process

12 / HKLM EXCHANGE

WHAT WE D0 (continued)

HKLM Exchnge is Tier Workiv prtner. Workiv nc, the leding cloud provider

of connected dt, reporting nd complince solutions, is used by thousnds

of enterprises cross 8 countries, including more thn 5% of Fortune 5®

compnies, nd by government gencies. Our customers hve linked over five billion

dt elements to trust their dt, reduce risk nd sve time.

Workiv’s primry product is Wdesk, cloud-bsed enterprise softwre-s--service

pltform tht enbles compnies to collect, mnge, report nd nlyse criticl

business dt in rel time. Wdesk lso llows compnies to mnge nd file finncil

nd complince documents to regultory gencies.

TECHNOLOGY PARTNERSHIPS

Unlesh the # reporting

nd complince

cloud pltform

Eliminte risk with

repetble, relible

processes

Mke better decisions

bsed on better dt

CONNECT AUTOMATE TRANSFORM

12 / HKLM EXCHANGE

WHAT WE DO / 13

PEOPLE, GROUPS AND SECURITY

Set ccess nd permissions so tht users see s much or s little s necessry. Security cn

scle to ccommodte the demnds of smll tems or full enterprises.

VERSION CONTROL

Everyone hs ccess to the ltest version. Eliminte checkout systems, emil trils nd

hndwritten notes. Simultneous nd controlled collbortion mens everyone hs the

right informtion.

DATA CONSISTENCY

Dt within Wdesk, whether ntive or imported, is connected cross the pltform. When

chnges occur, numbers nd nrrtive re utomticlly updted without mnul work.

HISTORY AND AUDIT TRAIL

A history tril is utomticlly creted nd sved ny time chnge is mde. Whether it is n

updte to single cell or mjor revisions to project, ll chnges re documented – providing

trnsprency to ll internl nd externl stkeholders.

FLEXIBLE INTEGRATIONS

Structured nd unstructured dt is esily brought into Wdesk to crete centrl nd

connected set of dt. Use nd reuse tht informtion to provide consistent documents nd

reports to investors, executives nd other stkeholders.

WORKFLOW AND TASKING

Users configure step-by-step workflows in Wdesk. Tsking fetures let users ssign

pprovls, reviews, reuests nd other functions. Wdesk improves eciency, enbling

tems to meet dedlines.

EASY TO USE

Wdesk is designed for business users nd reuires little to no trining. The pltform powers

documents, presenttions, dshbords nd other fmilir content types.

ALWAYS ACCESSIBLE

With the cloud pltform, reports re ccessible nywhere with n internet connection.

Access the informtion you need vi lptop, tblet or mobile phone. Users fit work into their

lives, insted of fitting their lives round work.

For more informtion bout Workiv (NYSE: WK), plese visit www.workiv.com.

Workiv nd Wdesk re registered trdemrks of Workiv nc.

14 / HKLM EXCHANGE

OUR

CLIENTS

HKLM

EXCHANGE

is a strategic

stakeholder

communication

advisory firm

DE VELO PMENT BANK O F SOUTHERN AFRICA

14 / HKLM EXCHANGE

KUMBA IRON ORE

OUR CLIENTS / 15

TOTAL INTEGRATED SERVICES AND

RISK SOLUTIONS PROVIDER

16 / HKLM EXCHANGE

Omni Holdings is diversified chemicls group tht supplies

chemicls nd specilised services nd solutions for the griculture,

mining nd chemicl ppliction industries. With its vision of leving

“Better World” the roup’s solutions promote the responsible use

of chemicls for helth, sfety nd lower environmentl impct,

with n incresing shift towrds clener technologies.

HKLM ssists Omni with comprehensive rnge of services

tht includes the gp nlysis, content dvisory nd copywriting

services s well s design, lyout, typesetting, proofreding nd

project mngement of the reports.

These services re delivered in the course of producing Omni’s

integrted report, nnul finncil sttements, sustinbility report

s well s other publictions, such s the results nnouncements,

nlyst presenttions nd nnul generl meeting.

OUR

WORK

I 64 I OMNIA INTEGRATED ANNUAL REPORT 2019

OMNIA INTEGRATED ANNUAL REPORT 2019 I 65 I OMNIA INTEGRATED ANNUAL REPORT 2019 I 66 I

OPERATIONAL PERFORMANCE

FINANCIAL PERFORMANCE

AGRICULTURE RSA This segment produces and trades in granular, liquid and speciality fertilizers and humates and value-

added services and solutions to a broad customer base including commercial and small-scale farmers, co-operatives and

wholesalers in South Africa. This business also supplies the Agriculture International, Mining RSA and Mining International

businesses

AGRICULTURE INTERNATIONAL This segment produces and trades in granular, liquid and speciality fertilizers and humates

and value-added services and solutions to a broad customer base outside South Africa

AGRICULTURE TRADING This segment relates to the wholesale and trading of agriculture commodities throughout Africa.

The Agriculture Trading model will be reviewed and realigned to improve the return on net working capital, the generation of

cash and to better leverage the Group’s market position

AGRICULTURE BIOLOGICAL This segment is involved in the research and development, production, distribution and sales of

a unique range of patented agriculture biological (AgriBio) products. The key product ranges include bio-stimulants, adjuvants,

crop protection products, liquid foliar fertilizers and soil conditioners for large-scale agriculture applications, including all row,

stone fruit, pasture and other crop types, as well as smaller pasture, lawn and garden applications

OPERATIONAL PERFORMANCE

AGRICULTURE DIVISION

Commentary

The Agriculture division’s net revenue increased by 2% to

R8 240 million (FY2018: R8 078 million) or decreased by 7%

excluding Agriculture Biological’s revenue of R711 million.

Operating profit decreased by 36% to R370 million

(FY2018: R574 million) or by 54% excluding Agriculture Biological,

predominantly due to challenges in economic activity, liquidity

constraints, regulation, currency fluctuations, cost pressures and

weather patterns.

Agriculture RSA’s net revenue increased to R4 487 million

(FY2018: R4 273 million) or by 5%. The business managed to

retain its customer base. However, due to the financial pressure

on farmers, as well as the competitive pressure by importers

and blenders, the usual margin for Omnia’s value-added products

were not achieved, impacting gross margins. Agriculture RSA

was further negatively impacted by a slowdown in the Mining

segment resulting in lower sales and therefore production

recoveries into that area. Inflated prices for phosphoric acid

continue to be paid which puts further pressure on margins.

However, with the nitrophosphate plant in the process of ramping

up, the Group will have a competitive advantage in the future.

A focus on reducing inventory levels after achieving lower than

planned sales volumes in season, resulted in low production

recoveries during the post season period.

Agriculture International’s net revenue decreased by 20% to

R2 081 million (FY2018: R2 592 million) and operating profit

decreased by 36% to R169 million (FY2018: R263 million). The

decline in the Agriculture International business is as a result of

management’s decision to limit exposure in Zimbabwe following

a further deterioration in the liquidity in that country. This also

translated into excess inventory as the product was rerouted.

Zimbabwe experienced increased economic challenges during

the year which led to a high inflation economic environment

coupled with liquidity problems. The functional currency change

in Zimbabwe resulted in a further reduction of R85 million

in operating profit for FY2019 vs FY2018. South America

experienced political and currency volatility, long droughts and

severe heat waves which resulted in low agriculture commodity

prices, and Zambia experienced general credit pressure which

made investment opportunities less attractive but improved

slightly due to an increase in contract business.

The decline in the Agriculture Trading business is due to a

reduction in sales following a strategy to focus on a higher

margin business.

Agriculture Biological is growing rapidly as planned, supported

by the acquisition of Oro Agri. The investment in Oro Agri has

continued to deliver on the international growth strategy. Even in

the tough South African conditions where most of the businesses

in the sector deteriorated, Oro Agri SA maintained the healthy

growth.

OPERATING CONTEXT

×

Low prices for key agriculture commodities have reduced fertilizer demand

×

Impact of drought and adverse weather patterns on planting patterns

Agriculture earnings profile has also been impacted by ammonia/urea prices

×

US dollar exchange rate

Increasing use of technology to maintain and increase crop yield

Tar get

FY2019 FY2019 % change FY2018

Revenue R million 8 240 2

8 078

Operating profit R million 370 36 574

Operating margin % 6 – 8 4.5 7.1

Profit before taxation R million 158 62 419

Segment assets R million 6 631 15 5 781

Net working capital R million 2 539 3 2 463

Net working capital ratio % 30.8 0.3 30.5

Return on net controlled assets % 4.0 3 7.0

FY2019 % change FY2018

Recordable c ase rate 0.28 55 0.62

Volume (tonnes) 1 210 606 15 1 420 817

Number of staf f 2 232 11 2 008

Number of retail outlets (Agriculture International business) 83 28 65

FINANCIAL PERFORMANCE

6 500

6 900

7 300

7 700

8 100

8 500

FY2019FY2018FY2017FY2016FY2015

REVENUE AND OPERATING PROFIT

(R million)

Revenue

Revenue

Operating profit

Operating profit

300

400

500

600

700

800

0

1 000

2 000

3 000

4 000

5 000

BiologicalTradingInternationalSouth Africa

REVENUE MIX

(R million)

FY2017

FY2018

FY2019

Initiatives and outlook

Initiatives Outlook

• Additional volumes

– K-humate (high margin and low working capital) increased production

capacity (Australia)

– Oro Agri (high margin and low working capital) full year contribution,

registration of new products, extended labels for increased market reach

and new distribution channels into high growth markets for organic

products, supported by a general market transition to environmentally

friendly and health-promoting products and the high cost of developing

and registering traditional molecules

– Cross -selling of Omnia and Oro Agri products across a growing

distribution platform and leveraging Oro Agri’s proven track record in

patents and trademark registrations and research and development

– Trade sales to fertilizer and explosives market resulting in higher volumes

through factories and the resultant reduction in unit cost

– Leveraging Oro Agri’s proven track record in patents and trademark

registrations and R&D

• Impact of nitrophosphate

– The reduction of input costs attributable to the nitrophosphate plant will

provide Omnia with a fundamental ad vantage over competitors from a

price and market dif ferentiation perspective

• Capital light model

– Focus on growing capital light business which leverages off existing

marketing and distribution channels and Omnia’s intellectual property

• South Africa

– Customer base remains stable

– Exiting capex investment cycle

– Largest South Afric an nitric acid

manufacturer with a competitive advantage

as a result of investment in abatement

technology and upgrade of manufacturing

facilities to meet world class standards:

° Negligible exposure to carbon tax

° Spare capacity allows for grow th when

market returns and expected reduction

in South African supply

° Youngest plants resulting in ef ficient

conversion and lower cost per tonne

produced

– Forecasted ammonia and urea price ratio is

expected to support margins

• International

– Portugal platform creates lower friction

R&D and registrations, low cost entry point

into EU and reduced cost of production

– Reduction in Zimbabwean volumes

expected. Agile approach with focus on

liquidating cash from Zimbabwe

– Positive outlook for AgriBio market

16 / HKLM EXCHANGE

OUR WORK / 17

I 6 I OMNIA INTEGRATED ANNUAL REPORT 2019 OMNIA INTEGRATED ANNUAL REPORT 2019 I 7 I

GEOGRAPHICAL OVERVIEW

MAJOR MANUFACTURING SITES

DISTRIBUTION

South Africa 32

International 19

Group total: 51

GROUP TOTAL MANUFACTURING

MINING

RSA: 9

International: 12

Total: 21

CHEMICALS

RSA: 6

INTERNATIONAL: 1

Total: 7

AGRICULTURE

RSA: 17

INTERNATIONAL: 6

Total: 23

South Africa 32

International 17

Group total: 49

GROUP TOTAL DISTRIBUTION

MINING

RSA: 21

International: 7

Total: 28

CHEMICALS

RSA: 5

INTERNATIONAL: 2

Total: 7

DISTRIBUTION INCLUDING

UMONGO PETROLEUM

AGRICULTURE

RSA: 6

INTERNATIONAL: 8

Total: 14

1 South Africa

South Africa

2 Southern Africa

Angola

Botswana

Lesotho

Mozambique

Namibia

Swaziland

Zimbabwe

3 East Africa

Kenya

1 Mauritius

1 Tanzania

4 Central Africa

DRC

Zambia

5 West Africa

Burkina Faso

Guinea

Mali

Mauritania

Senegal

Sierra Leone

Côte d’Ivoire

6 Australasia

Australia

New Zealand

7 Asia Pacific

China

India

Indonesia

Malaysia

Vietnam

Myanmar

Singapore

8 South America

Brazil

Paraguay

Chile

9 North America

Cayman Islands

Canada

Mexico

United States of America

10 Central America

Guatemala

11 Europe

Czech Republic

France

Italy

Germany

Netherlands

Portugal

Spain

United Kingdom

Greece

Turkey

Pakistan

* Romania

Agriculture Mining: BME Mining: Protea

Mining Chemicals

KEY

Chemicals Oro Agri

1

2

4 7

5

11

6

3

8

10

9

* Romania added after year-end.

FY2019

R million Revenue Operating profit

Total Agriculture 8 240 370

Total Mining 4 885 169

Total Chemicals 5 301 10

Head Office and elimination* – (525)

Reconciling items 202 –

Total 18 628 24

PHYSICAL PRESENCE IN 48 COUNTRIES

WITH 4 755 EMPLOYEES

CREATING SUSTAINABLE VALUE CONTINUED

* Includes the impairment of goodwill in Protea Chemicals

I 64 I OMNIA INTEGRATED ANNUAL REPORT 2019

OMNIA INTEGRATED ANNUAL REPORT 2019 I 65 I OMNIA INTEGRATED ANNUAL REPORT 2019 I 66 I

OPERATIONAL PERFORMANCE

FINANCIAL PERFORMANCE

AGRICULTURE RSA This segment produces and trades in granular, liquid and speciality fertilizers and humates and value-

added services and solutions to a broad customer base including commercial and small-scale farmers, co-operatives and

wholesalers in South Africa. This business also supplies the Agriculture International, Mining RSA and Mining International

businesses

AGRICULTURE INTERNATIONAL This segment produces and trades in granular, liquid and speciality fertilizers and humates

and value-added services and solutions to a broad customer base outside South Africa

AGRICULTURE TRADING This segment relates to the wholesale and trading of agriculture commodities throughout Africa.

The Agriculture Trading model will be reviewed and realigned to improve the return on net working capital, the generation of

cash and to better leverage the Group’s market position

AGRICULTURE BIOLOGICAL This segment is involved in the research and development, production, distribution and sales of

a unique range of patented agriculture biological (AgriBio) products. The key product ranges include bio-stimulants, adjuvants,

crop protection products, liquid foliar fertilizers and soil conditioners for large-scale agriculture applications, including all row,

stone fruit, pasture and other crop types, as well as smaller pasture, lawn and garden applications

OPERATIONAL PERFORMANCE

AGRICULTURE DIVISION

Commentary

The Agriculture division’s net revenue increased by 2% to

R8 240 million (FY2018: R8 078 million) or decreased by 7%

excluding Agriculture Biological’s revenue of R711 million.

Operating profit decreased by 36% to R370 million

(FY2018: R574 million) or by 54% excluding Agriculture Biological,

predominantly due to challenges in economic activity, liquidity

constraints, regulation, currency fluctuations, cost pressures and

weather patterns.

Agriculture RSA’s net revenue increased to R4 487 million

(FY2018: R4 273 million) or by 5%. The business managed to

retain its customer base. However, due to the financial pressure

on farmers, as well as the competitive pressure by importers

and blenders, the usual margin for Omnia’s value-added products

were not achieved, impacting gross margins. Agriculture RSA

was further negatively impacted by a slowdown in the Mining

segment resulting in lower sales and therefore production

recoveries into that area. Inflated prices for phosphoric acid

continue to be paid which puts further pressure on margins.

However, with the nitrophosphate plant in the process of ramping

up, the Group will have a competitive advantage in the future.

A focus on reducing inventory levels after achieving lower than

planned sales volumes in season, resulted in low production

recoveries during the post season period.

Agriculture International’s net revenue decreased by 20% to

R2 081 million (FY2018: R2 592 million) and operating profit

decreased by 36% to R169 million (FY2018: R263 million). The

decline in the Agriculture International business is as a result of

management’s decision to limit exposure in Zimbabwe following

a further deterioration in the liquidity in that country. This also

translated into excess inventory as the product was rerouted.

Zimbabwe experienced increased economic challenges during

the year which led to a high inflation economic environment

coupled with liquidity problems. The functional currency change

in Zimbabwe resulted in a further reduction of R85 million

in operating profit for FY2019 vs FY2018. South America

experienced political and currency volatility, long droughts and

severe heat waves which resulted in low agriculture commodity

prices, and Zambia experienced general credit pressure which

made investment opportunities less attractive but improved

slightly due to an increase in contract business.

The decline in the Agriculture Trading business is due to a

reduction in sales following a strategy to focus on a higher

margin business.

Agriculture Biological is growing rapidly as planned, supported

by the acquisition of Oro Agri. The investment in Oro Agri has

continued to deliver on the international growth strategy. Even in

the tough South African conditions where most of the businesses

in the sector deteriorated, Oro Agri SA maintained the healthy

growth.

OPERATING CONTEXT

×

Low prices for key agriculture commodities have reduced fertilizer demand

×

Impact of drought and adverse weather patterns on planting patterns

Agriculture earnings profile has also been impacted by ammonia/urea prices

×

US dollar exchange rate

Increasing use of technology to maintain and increase crop yield

Tar get

FY2019 FY2019 % change FY2018

Revenue R million 8 240 2

8 078

Operating profit R million 370 36

574

Operating margin % 6 – 8 4.5

7.1

Profit before taxation R million 158 62

419

Segment assets R million 6 631 15

5 781

Net working capital R million 2 539 3

2 463

Net working capital ratio % 30.8 0.3

30.5

Return on net controlled assets % 4.0 3

7.0

FY2019 % change FY2018

Recordable c ase rate 0.28 55

0.62

Volume (tonnes) 1 210 606 15

1 420 817

Number of staf f 2 232 11

2 008

Number of retail outlets (Agriculture International business) 83 28

65

FINANCIAL PERFORMANCE

6 500

6 900

7 300

7 700

8 100

8 500

FY2019FY2018FY2017FY2016FY2015

REVENUE AND OPERATING PROFIT

(R million)

Revenue

Revenue

Operating profit

Operating profit

300

400

500

600

700

800

0

1 000

2 000

3 000

4 000

5 000

BiologicalTradingInternationalSouth Africa

REVENUE MIX

(R million)

FY2017

FY2018

FY2019

Initiatives and outlook

Initiatives Outlook

• Additional volumes

– K-humate (high margin and low working capital) increased production

capacity (Australia)

– Oro Agri (high margin and low working capital) full year contribution,

registration of new products, extended labels for increased market reach

and new distribution channels into high growth markets for organic

products, supported by a general market transition to environmentally

friendly and health-promoting products and the high cost of developing

and registering traditional molecules

– Cross -selling of Omnia and Oro Agri products across a growing

distribution platform and leveraging Oro Agri’s proven track record in

patents and trademark registrations and research and development

– Trade sales to fertilizer and explosives market resulting in higher volumes

through factories and the resultant reduction in unit cost

– Leveraging Oro Agri’s proven track record in patents and trademark

registrations and R&D

• Impact of nitrophosphate

– The reduction of input costs attributable to the nitrophosphate plant will

provide Omnia with a fundamental ad vantage over competitors from a

price and market dif ferentiation perspective

• Capital light model

– Focus on growing capital light business which leverages off existing

marketing and distribution channels and Omnia’s intellectual property

• South Africa

– Customer base remains stable

– Exiting capex investment cycle

– Largest South Afric an nitric acid

manufacturer with a competitive advantage

as a result of investment in abatement

technology and upgrade of manufacturing

facilities to meet world class standards:

° Negligible exposure to carbon tax

° Spare capacity allows for grow th when

market returns and expected reduction

in South African supply

° Youngest plants resulting in ef ficient

conversion and lower cost per tonne

produced

– Forecasted ammonia and urea price ratio is

expected to support margins

• International

– Portugal platform creates lower friction

R&D and registrations, low cost entry point

into EU and reduced cost of production

– Reduction in Zimbabwean volumes

expected. Agile approach with focus on

liquidating cash from Zimbabwe

– Positive outlook for AgriBio market

18 / HKLM EXCHANGE

I 20 I OMNIA INTEGRATED ANNUAL REPORT 2019 OMNIA INTEGRATED ANNUAL REPORT 2019 I 21 I

OMNIA INTEGRATED ANNUAL REPORT 2019 I 22 I OMNIA INTEGRATED ANNUAL REPORT 2019 I 23 I

T

E

C

H

N

O

L

O

G

Y

3

Leveraging our distribution network to ensure the

safe and cost-effective delivery of products.

4

Offering managed services and solutions to

our customers.

1

Commodity procurement: Sourcing of raw

chemicals and material in bulk from across

the world.

2

Applying intellectual capital and technologies in

the production of innovative value-added products

and services.

CREATING VALUE FOR ALL STAKEHOLDERS THAT

IS SUSTAINABLE IN THE LONG TERM

Shareholders and investment community

Net loss after tax of R407 million

609 cents

loss per share

Credit rating

During July 2019 Global Credit Rating issued a debt rating of

BBB- (which is defined as “average credit quality relative to other

issuers or obligations in the same country”) and A3 (which is

defined as “average certainty of timely payment of short-term

obligations relative to other issuers or obligations in the same

country”) in the long and short term respectively.

Omnia does not have any listed debt securities and the amended

rating does not impact the restructuring of Omnia’s debt facilities

which was announced with the results on 25 June 2019, or the

implementation of the proposed R2 billion underwritten rights

offer, the proceeds of which will be used to reduce the Group’s

present debt levels.

Employees and trade unions

R2.0 billion in salaries and benefits

R30.9 million invested in training

71.8% black staff in South Africa

20% female representation

RCR of

0.36

Suppliers

R11 million supplier development spend*

R12 million enterprise development spend*

Communities

R2.8 million socio-economic spend

Government and regulators

BBBEE rating: Level 3

R169 million

paid in taxes

CREATING VALUE THROUGH THE

SIX CAPITAL MODEL

OMNIA RELIES ON VARIOUS RELATIONSHIPS

AND RESOURCES TO CREATE VALUE (INPUTS)

Financial capital

Financial capital, used to sustain and grow the

business, consists of funds generated from

operations, equity financing and debt financing.

Human capital

Developing passionate, enabled and engaged

employees plays a critical role in attaining

Omnia’s vision and delivering on the defined

strategy.

Intellectual capital

The Group’s research, development, technology

and digital capabilities, which is considered a

competitive advantage, supports the development

of innovative products and solutions, efficient use

of natural resources, lowering the impact to the

environment, and improved safety for all.

Manufacturing capital

The Group continues to invest in modern

technologies and the upgrading of manufacturing

plants and equipment, to ensure that they are

world-class, safe to operate and conform to the

relevant regulations and standards.

Natural capital

Omnia requires a wide variety of minerals, water,

energy and air as raw materials to convert into

value-adding products and services.

Social and relationship capital

The operations are intricately linked to the

community where offices/plants are located and

hence Omnia nurtures the community and the

people around it.

APPLIED THROUGHOUT THE GLOBALLY

INTEGRATED VALUE CHAIN

PROVIDING HIGH-QUALITY PRODUCTS AND

SERVICES, FOCUSING ON NICHE AREAS

Agriculture

• Fertilizer – approximately 250 products including dry, liquid,

specialities (including humic acids and biological products)

and directly applied ammonia

• Nutriology™ research, development, laboratory services,

field services and advice

• Co-generation and re-use of resources

• Axioteq™ data services, advisory and data platform for the

development of commercialised solutions for customers

across the value chain

• Oro Agri – approximately 30 products with over

100 product registrations in various jurisdictions

Mining

• BME – approximately 44 products including

explosives, initiating systems (electronic and

non-electronic), blasting emulsions, blasting

software and other blasting accessories

• BME – on-mine blasting services

• Protea Mining Chemicals – approximately

150 products including a wide range of chemical-

based solutions used in mine processing plants

to enhance the recovery rates from ore and

concentrate

• Protea Process™ – advising on or managing the

logistics for the safe and efficient handling of

hazardous chemicals for clients on a full end-to-

end basis

Chemicals

• Protea Chemicals – approximately 1 200 products including

a wide range of liquid, dry and gas chemicals that are

packaged, transported, blended or manufactured for clients

• Formulated chemicals to customer specifications

• Protea Process™ – advising on or managing the logistics for

the safe and efficient handling of hazardous chemicals for

clients on a full end-to-end basis

• Umongo Petroleum – approximately 350 products including a

wide range of additive, base oils and speciality products that

are sourced, stored, packaged and transported for clients.

• Orbichem Petrochemicals – approximately 80 products

including a wide range of additive, base oils and speciality

products that are sourced, stored, packaged and

transported for clients.

P

r

o

c

u

r

e

m

e

n

t

D

I

G

I

T

A

L

INNOVATION

C

o

m

m

o

d

i

t

y

D

i

s

t

r

i

b

u

t

i

o

n

M

a

n

a

g

e

d

S

e

r

v

i

c

e

s

a

n

d

S

o

l

u

t

i

o

n

s

P

r

o

d

u

c

t

i

o

n

CREATING SUSTAINABLE VALUE CONTINUED

CAPITALS (INCORPORATED CROSS REFERENCE)

UNDERPINNED BY OPERATING FRAMEWORK:

Culture Leadership People Skills Governance Systems Processes Innovation Structure Ways of working SHERQ Performance management

Financial Refer to the A FS for more information

Human Refer to pages 2 6 to 30 in the ESG repor t for more information

Intellectual Refer to pages 41 and 42 in the IAR for more information

Manufactured Refer to pages 16 to 19 in the I AR for more information

Natural Refer to pages 44 to 49 in the ESG for more information

Social and relationship Refer to pages 31 to 38 in the ESG report for more information

* Based on unaudited fi gures (current BBBEE certifi cate is valid until

13 September 2019)

Value is created by applying intellectual property and advanced technologies in the research, development, manufacturing,

distribution of products and provision of advisory services in the agriculture, mining and chemicals sectors.

SIX CAPITAL OUTCOMES AND

TRADE-OFFS IN CAPITAL

KEY INPUTS

Financial capital

Debt raised during the year of R1.7 billion

Share capital and reserves of R7 225 million

Cash and cash equivalent of R644 million

Human capital

Total workforce of 4 755

Strong core belief systems and a high-performance culture

Engagement with unionised and non-unionised workforce

Intellectual capital

291 pending trademark applications

1 317 registered trade marks

37 pending patent applications

238 registered patents

Nil pending design applications

9 registered designs

Direct investment of

R22 million into research and

development

174 agronomists and scientists

20

IT programmers for Axioteq

TM

/DigiAg

TM

(commercial

agriculture digital platform), Nutriology™/OAP

(an in-house specialist agriculture digital platform) and

Nutriology™ Manufacturing Execution System/(MES) (an

in-house software system built on the Microsoft platform)

o 2 software developers for AXXIS

TM

o 1 software developer for BLASTMAP

TM

o 3 software developers for XPLOLOG

TM

Manufacturing capital

32

manufacturing plants in South Africa and

19

internationally

49 distribution centres across the world

70 engineers

Property, plant and equipment of

R5.4 billion

Natural capital

72 052 MhW electricity consumed

1 696 million litres of water used

Social and relationship capital

Active participation in public policy forums

Ongoing engagement with government and regulators

OUTCOMES PER CAPITAL

FY2019 FY2018

Human capital

outcomes

Amounts paid in salaries,

wages and benefits R2.0 billion R1.8 billion

Employee turnover rate × 25.9% 9.6%

Number of retrenchments × 115 40

Number of work-related

employee and service provider

fatalities – 2

Recordable case rate (RCR) 0.36 0.47

Direct ownership by Sakhile 1

and Sakhile 2 in Omnia Group

(Pty) Ltd 13.5% 13.5%

Investment in training and

staff welfare R30.9 million R34 million

Training – average number of

days per employee per annum 11.4 d ay s 12.0 d ay s

Actions to enhance outcomes

• Rollout of the Omnia culture programme

• Continue to focus on employee development, safety and wellbeing

CREATING SUSTAINABLE VALUE CONTINUED

FY2019 F Y2018

Intellectual capital

outcomes

Carrying amount of trademarks,

patents and distribution

contracts R1.3 billion R453 million

Additions to goodwill and

intangible assets R1.4 billion R811 million

Impairments to goodwill × R324 million –

Amortisation expenditure × R197 million R62 million

Number of ex ternal bursaries

awarded 6 7

Number of employees

suppor ted with bursaries /in

part-time studying 186 128

Number of employees in

work-integrated learning

programme 364 402

Number of employees in

artisans, learnerships and

PIVOTA L programmes 286 268

Actions to enhance outcomes

• Continued investing in research, development and par tnerships to

develop new technologies

• Seeking new technologies through acquisition opportunities over

the medium - to long -term

FY2019 FY2018

Manufacturing capital

outcomes

Capital expenditure (total) R1.1 billion R887 million

Depreciation × R418 million R384 million

Impairment of plant × R16 million –

Actions to enhance outcomes

• Bringing new nitrophosphate plant to full capacit y

• Omnia has reached the end of its recent capex programme

• Maintenance capex is expected to continue in the medium-term,

mainly at Sasolburg manufacturing facilities

UNDERSTANDING THE KEY TRADE-OFFS IN

CAPITAL IN THE YEAR

Acquisition of Oro Agri

On 1 May 2018, Omnia effectively acquired 100% of

the ordinary shares of Oro Agri SEZC Limited and its

subsidiaries (Oro Agri) for a purchase consideration of

$100 million, funded from a combination of cash and

debt. Oro Agri is an international company involved in the

research and development, production, distribution and

sales of a unique range of patented AgriBio products. The

key product ranges include bio-pesticides, bio-stimulants

and bio-fertilizers as well as adjuvants, crop protection

products, liquid foliar fertilizers and soil conditioners. Clients

include farmers with large-scale agriculture applications

across all row, stone fruit, pasture and other crop types, as

well as smaller pastures, lawn and garden applications.

Notwithstanding a robust due diligence process, the

acquisition has impacted cash flows, financing charges and

debt ratios negatively in the short term. The products and

services offered by Oro Agri will support Omnia in positioning

itself with the next generation of agriculture products to

further enhance yield and optimise crop performance whilst

lowering the environmental impact of crop production.

Restructuring of Protea Chemicals

Protea Chemicals embarked on an organic growth strategy

over the past two years. Growth was sought through

organic growth in South Africa, with the addition of certain

product lines and through entering new territories. While

growth was achieved in parts of Africa, the growth and

margin aspirations were not achieved in South Africa. The

economic conditions in the region and severe competitive

pressure further impacted the business negatively and

margins deteriorated to the point that the current business

model and growth strategy is not considered appropriate in

the current economic environment.

Consequently, the Protea Chemicals’ strategy and business

model was reviewed and realigned to create a more

focused business for the future. Part of the process led

to the unavoidable retrenchment of 115 employees. It is

estimated that the associated restructuring costs amounted

to R35 million.

It is envisaged that the benefits, estimated at R75 million

per annum, of the restructuring process will only be realised

in the next financial year. Phase two of the process has

commenced which will result in additional annual savings

and improved quality of business as part of its newly

developed strategy.

Outcome key

Positive outcome

≈ Neutral outcome

× Negative outcome

FY2019 FY2018

Social and relationship

capital outcomes

Spending on social investment

(including emerging farmer

programme) R25.3 million R55.1 million

Broad-Based Black Economic

Empowerment status Level 3 Level 3

Workdays lost due to industrial

action Nil days Nil days

Actions to enhance outcomes

• Continued engagement with communities, industry and government

bodies

• Continued engagement with staff at all levels about strategic and

cultural matters

FY2019 FY2018

Financial capital

outcomes

Operating profit × R24 million R1 156 million

(Loss)/ profit after tax × (R407 million) R664 million

Cash generated from/(utilised in)

operating activities R998 million (R133 million)

Net interest-bearing borrowings × R4 403 million R2 542 million

Headline earnings per share × ( R1.12) R9.91

Dividends paid to shareholders

(including prior year final dividend

paid in the current year) × R153 million R262 million

Dividends per share × R0.75 R3.50

Net asset value per share × R105 R10 8

Closing share price at year-end × R50.90 R149.00

Actions to enhance outcomes

•

R2 billion new capital injection (rights offer) to bring the company’s

debt levels within capacity, provide the Group with adequate

headroom in its debt facilities, ensure capital structure is more closely

aligned to peers and improve cost of capital

• Improve operating leverage – seek cost savings across the Group

• Reduce working capital – Fertilizer RSA will reduce working capital

through sales and operations planning, inventory reduction across

Agriculture International, Innofert and Protea Chemicals; focus on

debtor collection and terms; and renegotiation of creditor terms

where possible

• Fertilizer RSA will enter into trade sales with distributors to utilise

excess capacity from Sasolburg

OUR WORK (continued)

18 / HKLM EXCHANGE

OUR WORK / 19

I 20 I OMNIA INTEGRATED ANNUAL REPORT 2019 OMNIA INTEGRATED ANNUAL REPORT 2019 I 21 I

OMNIA INTEGRATED ANNUAL REPORT 2019 I 22 I OMNIA INTEGRATED ANNUAL REPORT 2019 I 23 I

T

E

C

H

N

O

L

O

G

Y

3

Leveraging our distribution network to ensure the

safe and cost-effective delivery of products.

4

Offering managed services and solutions to

our customers.

1

Commodity procurement: Sourcing of raw

chemicals and material in bulk from across

the world.

2

Applying intellectual capital and technologies in

the production of innovative value-added products

and services.

CREATING VALUE FOR ALL STAKEHOLDERS THAT

IS SUSTAINABLE IN THE LONG TERM

Shareholders and investment community

Net loss after tax of R407 million

609 cents

loss per share

Credit rating

During July 2019 Global Credit Rating issued a debt rating of

BBB- (which is defined as “average credit quality relative to other

issuers or obligations in the same country”) and A3 (which is

defined as “average certainty of timely payment of short-term

obligations relative to other issuers or obligations in the same

country”) in the long and short term respectively.

Omnia does not have any listed debt securities and the amended

rating does not impact the restructuring of Omnia’s debt facilities

which was announced with the results on 25 June 2019, or the

implementation of the proposed R2 billion underwritten rights

offer, the proceeds of which will be used to reduce the Group’s

present debt levels.

Employees and trade unions

R2.0 billion in salaries and benefits

R30.9 million invested in training

71.8% black staff in South Africa

20% female representation

RCR of

0.36

Suppliers

R11 million supplier development spend*

R12 million enterprise development spend*

Communities

R2.8 million socio-economic spend

Government and regulators

BBBEE rating: Level 3

R169 million

paid in taxes

CREATING VALUE THROUGH THE

SIX CAPITAL MODEL

OMNIA RELIES ON VARIOUS RELATIONSHIPS

AND RESOURCES TO CREATE VALUE (INPUTS)

Financial capital

Financial capital, used to sustain and grow the

business, consists of funds generated from

operations, equity financing and debt financing.

Human capital

Developing passionate, enabled and engaged

employees plays a critical role in attaining

Omnia’s vision and delivering on the defined

strategy.

Intellectual capital

The Group’s research, development, technology

and digital capabilities, which is considered a

competitive advantage, supports the development

of innovative products and solutions, efficient use

of natural resources, lowering the impact to the

environment, and improved safety for all.

Manufacturing capital

The Group continues to invest in modern

technologies and the upgrading of manufacturing

plants and equipment, to ensure that they are

world-class, safe to operate and conform to the

relevant regulations and standards.

Natural capital

Omnia requires a wide variety of minerals, water,

energy and air as raw materials to convert into

value-adding products and services.

Social and relationship capital

The operations are intricately linked to the

community where offices/plants are located and

hence Omnia nurtures the community and the

people around it.

APPLIED THROUGHOUT THE GLOBALLY

INTEGRATED VALUE CHAIN

PROVIDING HIGH-QUALITY PRODUCTS AND

SERVICES, FOCUSING ON NICHE AREAS

Agriculture

• Fertilizer – approximately 250 products including dry, liquid,

specialities (including humic acids and biological products)

and directly applied ammonia

• Nutriology™ research, development, laboratory services,

field services and advice

• Co-generation and re-use of resources

• Axioteq™ data services, advisory and data platform for the

development of commercialised solutions for customers

across the value chain

• Oro Agri – approximately 30 products with over

100 product registrations in various jurisdictions

Mining

• BME – approximately 44 products including

explosives, initiating systems (electronic and

non-electronic), blasting emulsions, blasting

software and other blasting accessories

• BME – on-mine blasting services

• Protea Mining Chemicals – approximately

150 products including a wide range of chemical-

based solutions used in mine processing plants

to enhance the recovery rates from ore and

concentrate

• Protea Process™ – advising on or managing the

logistics for the safe and efficient handling of

hazardous chemicals for clients on a full end-to-

end basis

Chemicals

• Protea Chemicals – approximately 1 200 products including

a wide range of liquid, dry and gas chemicals that are

packaged, transported, blended or manufactured for clients

• Formulated chemicals to customer specifications

• Protea Process™ – advising on or managing the logistics for

the safe and efficient handling of hazardous chemicals for

clients on a full end-to-end basis

• Umongo Petroleum – approximately 350 products including a

wide range of additive, base oils and speciality products that

are sourced, stored, packaged and transported for clients.

• Orbichem Petrochemicals – approximately 80 products

including a wide range of additive, base oils and speciality

products that are sourced, stored, packaged and

transported for clients.

P

r

o

c

u

r

e

m

e

n

t

D

I

G

I

T

A

L

INNOVATION

C

o

m

m

o

d

i

t

y

D

i

s

t

r

i

b

u

t

i

o

n

M

a

n

a

g

e

d

S

e

r

v

i

c

e

s

a

n

d

S

o

l

u

t

i

o

n

s

P

r

o

d

u

c

t

i

o

n

CREATING SUSTAINABLE VALUE CONTINUED

CAPITALS (INCORPORATED CROSS REFERENCE)

UNDERPINNED BY OPERATING FRAMEWORK:

Culture Leadership People Skills Governance Systems Processes Innovation Structure Ways of working SHERQ Performance management

Financial Refer to the A FS for more information

Human Refer to pages 2 6 to 30 in the ESG repor t for more information

Intellectual Refer to pages 41 and 42 in the IAR for more information

Manufactured Refer to pages 16 to 19 in the I AR for more information

Natural Refer to pages 44 to 49 in the ESG for more information

Social and relationship Refer to pages 31 to 38 in the ESG report for more information

* Based on unaudited fi gures (current BBBEE certifi cate is valid until

13 September 2019)

Value is created by applying intellectual property and advanced technologies in the research, development, manufacturing,

distribution of products and provision of advisory services in the agriculture, mining and chemicals sectors.

SIX CAPITAL OUTCOMES AND

TRADE-OFFS IN CAPITAL

KEY INPUTS

Financial capital

Debt raised during the year of R1.7 billion

Share capital and reserves of R7 225 million

Cash and cash equivalent of R644 million

Human capital

Total workforce of 4 755

Strong core belief systems and a high-performance culture

Engagement with unionised and non-unionised workforce

Intellectual capital

291 pending trademark applications

1 317 registered trade marks

37 pending patent applications

238 registered patents

Nil pending design applications

9 registered designs

Direct investment of

R22 million into research and

development

174 agronomists and scientists

20

IT programmers for Axioteq

TM

/DigiAg

TM

(commercial

agriculture digital platform), Nutriology™/OAP

(an in-house specialist agriculture digital platform) and

Nutriology™ Manufacturing Execution System/(MES) (an

in-house software system built on the Microsoft platform)

o 2 software developers for AXXIS

TM

o 1 software developer for BLASTMAP

TM

o 3 software developers for XPLOLOG

TM

Manufacturing capital

32

manufacturing plants in South Africa and

19

internationally

49 distribution centres across the world

70 engineers

Property, plant and equipment of

R5.4 billion

Natural capital

72 052 MhW electricity consumed

1 696 million litres of water used

Social and relationship capital

Active participation in public policy forums

Ongoing engagement with government and regulators

OUTCOMES PER CAPITAL

FY2019 FY2018

Human capital

outcomes

Amounts paid in salaries,

wages and benefits R2.0 billion R1.8 billion

Employee turnover rate × 25.9% 9.6%

Number of retrenchments × 115 40

Number of work-related

employee and service provider

fatalities – 2

Recordable case rate (RCR) 0.36 0.47

Direct ownership by Sakhile 1

and Sakhile 2 in Omnia Group

(Pty) Ltd 13.5% 13.5%

Investment in training and

staff welfare R30.9 million R34 million

Training – average number of

days per employee per annum 11.4 d ay s 12.0 d ay s

Actions to enhance outcomes

• Rollout of the Omnia culture programme

• Continue to focus on employee development, safety and wellbeing

CREATING SUSTAINABLE VALUE CONTINUED

FY2019 F Y2018

Intellectual capital

outcomes

Carrying amount of trademarks,

patents and distribution

contracts R1.3 billion R 453 million

Additions to goodwill and

intangible assets R1.4 billion R811 million

Impairments to goodwill × R324 million –

Amortisation expenditure × R197 million R62 million

Number of ex ternal bursaries

awarded 6 7

Number of employees

suppor ted with bursaries /in

part-time studying 186 128

Number of employees in

work-integrated learning

programme 364 402

Number of employees in

artisans, learnerships and

PIVOTA L programmes 286 268

Actions to enhance outcomes

• Continued investing in research, development and par tnerships to

develop new technologies

• Seeking new technologies through acquisition opportunities over

the medium - to long -term

FY2019 FY2018

Manufacturing capital

outcomes

Capital expenditure (total) R1.1 billion R887 million

Depreciation × R418 million R38 4 million

Impairment of plant × R16 million –

Actions to enhance outcomes

• Bringing new nitrophosphate plant to full capacit y

• Omnia has reached the end of its recent capex programme

• Maintenance capex is expected to continue in the medium-term,

mainly at Sasolburg manufacturing facilities

UNDERSTANDING THE KEY TRADE-OFFS IN

CAPITAL IN THE YEAR

Acquisition of Oro Agri

On 1 May 2018, Omnia effectively acquired 100% of

the ordinary shares of Oro Agri SEZC Limited and its

subsidiaries (Oro Agri) for a purchase consideration of

$100 million, funded from a combination of cash and

debt. Oro Agri is an international company involved in the

research and development, production, distribution and

sales of a unique range of patented AgriBio products. The

key product ranges include bio-pesticides, bio-stimulants

and bio-fertilizers as well as adjuvants, crop protection

products, liquid foliar fertilizers and soil conditioners. Clients

include farmers with large-scale agriculture applications

across all row, stone fruit, pasture and other crop types, as

well as smaller pastures, lawn and garden applications.

Notwithstanding a robust due diligence process, the

acquisition has impacted cash flows, financing charges and

debt ratios negatively in the short term. The products and

services offered by Oro Agri will support Omnia in positioning

itself with the next generation of agriculture products to

further enhance yield and optimise crop performance whilst

lowering the environmental impact of crop production.

Restructuring of Protea Chemicals

Protea Chemicals embarked on an organic growth strategy

over the past two years. Growth was sought through

organic growth in South Africa, with the addition of certain

product lines and through entering new territories. While

growth was achieved in parts of Africa, the growth and

margin aspirations were not achieved in South Africa. The

economic conditions in the region and severe competitive

pressure further impacted the business negatively and

margins deteriorated to the point that the current business

model and growth strategy is not considered appropriate in

the current economic environment.

Consequently, the Protea Chemicals’ strategy and business

model was reviewed and realigned to create a more

focused business for the future. Part of the process led

to the unavoidable retrenchment of 115 employees. It is

estimated that the associated restructuring costs amounted

to R35 million.

It is envisaged that the benefits, estimated at R75 million

per annum, of the restructuring process will only be realised

in the next financial year. Phase two of the process has

commenced which will result in additional annual savings

and improved quality of business as part of its newly

developed strategy.

Outcome key

Positive outcome

≈ Neutral outcome

× Negative outcome

FY2019 FY2018

Social and relationship

capital outcomes

Spending on social investment

(including emerging farmer

programme) R25.3 million R55.1 million

Broad-Based Black Economic

Empowerment status Level 3 Level 3

Workdays lost due to industrial

action Nil days Nil days

Actions to enhance outcomes

• Continued engagement with communities, industry and government

bodies

• Continued engagement with staff at all levels about strategic and

cultural matters

FY2019 FY2018

Financial capital

outcomes

Operating profit × R24 million R1 156 million

(Loss)/ profit after tax × (R407 million) R664 million

Cash generated from/(utilised in)

operating activities R998 million (R133 million)

Net interest-bearing borrowings × R4 403 million R2 542 million

Headline earnings per share × ( R1.12) R9.91

Dividends paid to shareholders

(including prior year final dividend

paid in the current year) × R153 million R262 million

Dividends per share × R0.75 R3.50

Net asset value per share × R105 R10 8

Closing share price at year-end × R50.90 R149.00

Actions to enhance outcomes

•

R2 billion new capital injection (rights offer) to bring the company’s

debt levels within capacity, provide the Group with adequate

headroom in its debt facilities, ensure capital structure is more closely

aligned to peers and improve cost of capital

• Improve operating leverage – seek cost savings across the Group

• Reduce working capital – Fertilizer RSA will reduce working capital

through sales and operations planning, inventory reduction across

Agriculture International, Innofert and Protea Chemicals; focus on

debtor collection and terms; and renegotiation of creditor terms

where possible

• Fertilizer RSA will enter into trade sales with distributors to utilise

excess capacity from Sasolburg

20 / HKLM EXCHANGE

Fidelity Services roup is southern Afric’s lrgest

integrted security solutions provider nd the

industry leder in protection innovtion. By keeping

brest of the ltest trends nd technologicl

developments globlly, nd continuously evolving

nd innovting, the group remins front runner in

the security solutions mrket.

HKLM ws engged to produce the 2 integrted

report for Fidelity Services roup, with the im of

providing our client with report tht reflected their

commitment to ulity integrted reporting. Prt of

FIDELITY SERVICES GROUP INTEGRATED ANNUAL REPORT 2019

KEEPING YOU SAFE | SECURING YOUR ASSETS

S E R V I C E S G R O U P

INTEGRATED

ANNUAL REPORT 2019

TOTAL INTEGRATED SERVICES AND

RISK SOLUTIONS PROVIDER

OUR WORK (continued)

20 / HKLM EXCHANGE

the brief ws for the gency to guide our client through the

process, structure, design nd copy.

A ulity report ws produced tht reflected Fidelity’s first steps

nd commitment to, integrted reporting. The report lso fulfilled

the brief of providing the compny with n ttrctive, esy-to-

nvigte corporte reporting sset tht ccurtely portrys

Fidelity’s integrted thinking with regrd to ll its divisionl,

dministrtive, governnce nd sustinbility inititives.

Fidelity’s integrted report ws the unlisted compny ctegory

winner in 2 t the hrtered Secretries Southern Afric 2

ntegrted Reporting Awrds.

OUR WORK / 21

22 / HKLM EXCHANGE

Our integrated facilities management services are offered through six operating divisions.

WHO WE ARE CONTINUED

CASH MANAGEMENT

SERVICES

• Banks and financial institutions

• Cash in transit (CIT)

• Integrated cash solutions

• ATM management

• Cash processing

• Cash acceptance devices

• Insurance

CLEANING

SERVICES

Professionally trained staff, using

environmentally-friendly products,

providing:

• Contract cleaning

• Hygiene services

• Pest control services

• Landscaping services

• Job safety analysis

• Critical emergencies control with ER24

TECHNOLOGY, ARMED RESPONSE,

ASSET TRACKING AND FIRE

SOLUTIONS

Technology and armed response

• Monitoring and armed response

• Electronic article surveillance

• Technical installations

• Commercial

• Fence solutions

Asset tracking

In partnership with Amber Connect, state-of-the-art

technology that is:

• Applications-based, scalable, dynamic data

insights-driven platform

• Customised user-friendly interfaces with

AI for enhanced functionality

Fire solutions

• Total integrated fire solutions

• Design and implementation

• Service, installation and maintenance

• Specialised and portable fire products

• SANS-compliant systems

• ATEX-compliant detection systems

SPECIALISED

SERVICES

• Tactical air and ground support

• VIP and event management

• Parking management

• National Command Centre

• Mining services

• Unrest and riot squad

• Private investigations

• Private prosecution assistance

and case management

• Rhino protection

SECURITY SERVICES

• Residential and golf estates

• Shopping centres and retail

• Banks and financial institutions

• Casino and gaming

• Commercial and industry

• Government and state-owned entities

• Health and education

• Hospitality

• Oil and gas

• Ports and airports

• Armed escorts

O

U

R

S

I

X

O

P

E

R

A

T

I

N

G

D

I

V

I

S

I

O

N

S

O

U

R

S

I

X

O

P

E

R

A

T

I

N

G

D

I

V

I

S

I

O

N

S

INTEGRATED FINANCIAL

SERVICES

• Micro loans

• Insurance for employees

• Insurance for customers

• Credit Life policy

• Financial counselling and advisory ser vices

For more on how our serie s and business offerings form the outp uts of our business processes, s ee our value-creating b usiness plan on page 26 .

O

U

R

O

P

E

R

A

T

I

N

G

S

T

R

U

C

T

U

R

E

FIDELITY Integrated Annual Report 2019 76 FIDELITY Integrated Annual Report 2019

WHO WE ARE CONTINUED

ABOUT OUR SHAREHOLDERS

SUPPORTED BY

Group Business Processes and Synergies

As at 28 February 2019, the relative stakes of our shareholders were as shown in the diagram below.

6(59,&(6 *5283

CASH

MANAGEMENT

SERVICES

(CMS)

SECURITY

SERVICES

TECHNOLOGY,

ARMED

RESPONSE, ASSET

TRACKING

AND FIRE

SOLUTIONS

New Seasons (31.08%)

The New Seasons group was founded in 1995. The directors

have significant and diversified business experience and a

proven track record with black economic empowerment

(BEE) investments. New Seasons Equity Fund enhanced its

shareholding in the Group in the past year through its merger

with Nodus Equity, thereby combining their interests into

one holding company controlled by New Seasons.

Dickerson Investments (11.00%)

Dickerson Investments Proprietar y Limited is a privately-

owned investment company. Mr Robert Dickerson was

the former Chief Executive Officer of the Fidelity Services

Group, until the unbundling of the Group in 2006. His wealth

of experience in the securit y and related ser vice industries

enables him to provide an invaluable contribution as a

non-executive director of the current FSG Board.

Employees and Management, including The

Guarding Trust, Eagle Creek Investments 393

and Holdco-Guarding Share Participation Trust

Selected employees and management participate in an

equity scheme in recognition of their commitment, loyalty

and performance. The employee share scheme functions

on an ongoing basis, supporting employee motivation by

providing wealth creation as part of the Group’s employee

valuation strategy. The outcome is a prosperous investment

management company that drives a sustainable business

and delivers investor value.

Shalamuka Security (19.96%)

Shalamuka Security is a broad-based black economic

empowerment (B-BBEE) private equity company which

invests in unlisted established businesses across all sectors.

Operating as a BEE investment vehicle, Shalamuka Capital

was started in 2008 when the Shalamuka Foundation

was looking to invest in private equity and partnered with

RMBCorvest.

31.08

%

19.96

12.25

11.00

15.86

9.85

Corvest 6 (12.25%)

RMB Corvest is a private

equity company and is a

member of the FirstRand

Group. RMB Corvest has

remained invested in the

Fidelity Group for over

25years.

New Seasons

Shalamuka Security

Eagle Creek

Corvest 6

Dickerson Investments

Employees and

Management

INTEGRATED

FINANCIAL

SERVICES

CORPORATE

SUPPORT AND

ADMINISTRATION

CLEANING

SERVICES

OUR BUSINESS DIVISIONAL STRUCTURE

FIDELITY Integrated Annual Report 2019 98 FIDELITY Integrated Annual Report 2019

TOTAL INTEGRATED SERVICES AND

RISK SOLUTIONS PROVIDER

OUR WORK (continued)

22 / HKLM EXCHANGE

OUR WORK / 23OUR WORK / 23

CREATING VALUE CONTINUED

OUR VALUE-CREATING BUSINESS MODEL

Fidelity creates value mainly through the sustainable provision of a variety of security services in guarding, cash solutions, armed

response, fire detection and suppression, cleaning and hygiene and integrated technology services across Southern Africa.

Our six capital INPUTS

LEADING TO THE CREATION OF VALUE

THROUGH OUTCOMES FOR OUR

STAKEHOLDERS

IMPLEMENTED THROUGH

AN ENTREPRENEURIAL

CULTURE OF:

• Unique training and systems

• Proprietar y posting and deployment of guards and crews

• Support processes and systems

• Profitability by sector, branch, site, route, security officer

• Business intelligence

• Research and development, registered patents

• Innovative technology

• Acquisitions

• Manufacturing

SECURITY

SERVICES

ASSET TRACKING

– FIDELITY

SECUREDRIVE

CASH

MANAGEMENT

SOLUTIONS

FIRE

SOLUTIONS

I

N

T

E

G

R

A

T

I

N

G

S

U

P

P

O

R

T

,

S

E

R

V

I

C

E

S

,

P

R

O

D

U

C

T

S

A

N

D

T

E

C

H

N

O

L

O

G

Y

T

O

D

E

L

I

V

E

R

O

U

T

P

U

T

S

*

(For more on our services a nd business offerings,

see Our operating structure on page 6 .*)

CLEANING

SERVICES

INTEGRATED

FINANCIAL

SERVICES

SPECIALISED

SERVICES

TECHNOLOGY

AND ARMED

RESPONSE

National Command Centre

• Operating 24/7, the first of its kind in South

Africa; the centre specialises in remote risk

management

• Tracking assets and vehicles countrywide

• Expert monitoring teams

• Fully equipped disaster recovery site with a

comprehensive business continuity plan

• Infrastructure standards that exceed the

minimum South African Intruder Detection

Services Association requirements

Training and Development

As a pioneer of training in South Africa, the

Group developed:

• The first learnership programme for

security officers with SASSETA

(NQF Level 3)

• Its own comprehensive firearm training

programmes

• Extensive accreditations

It also revamped Mutango Lodge.

CSI

The objective is to create a sustainable

environment outside of the business that

provides for:

• Long-term physically and socially

sustainable improvement in the

environment

• Care Fund

• The Fidelity Foundation

• Environmental sustenance

• Enterprise and supplier development

• Sponsors/joint CSI projects

IN TERMS OF TRADE-OFFS, CREATING

VALUE IN THE MEDIUM TO LONG TERM

Investment reduces our financial

capital, but our:

Social and relationship capital, through learnerships, Fidelity

Foundation, Care Fund, Tax benefits, Industry leadership

Human capital, through the promotion and acquisition of skills

learnerships Mutango Lodge

Manufactured capital, through proprietary devices, learnerships

software and added-value product and service offering

Intellectual capital, through innovative technology, systems and services

Natural capital, through beneficial measures reducing our impact

on the environment

Manufactured capital – fleet, buildings,

firearms, hardware, devices utilised in

the provision of services

Human capital – our employees,

bringing with them skills, experience

and expertise

Financial capital – revenues flowing

from services we provide

R

Intellectual capital – skills, experience,

expertise, software, systems, training

and procedures supporting the provision

of services

Social and relationship capital –

embodied in the relationships we have

with our shareholders and stakeholders,

and our commitment to corporate social

investment (CSI)

Natural capital – the measures we take

to lessen the impact on the environment

in the areas and communities in which

we operate

SHAREHOLDERS

13.43%

l Equity growth

R9.43 billion l Revenue

R398 million l PBIT

REGULATORS

Full compliance with relevant legislation, governance

frameworks and industry standards

STRATEGIC PARTNERS

Innovative technology

and proprietary manufacturing

SUPPLIERS

B-BBEE level 1 rating, global best-of-breed services,

technology and equipment

CUSTOMERS

Tailored end-to-end, cost-efficient, value-added

comprehensive solutions

EMPLOYEES

Skills advancement, meritocratic workplace environment,

superior training, insurance, wellness and assistance

FIDELITY Integrated Annual Report 2019 3130 FIDELITY Integrated Annual Report 2 019

GROUP FINANCIAL

DIRECTOR’S REPORT

GROUP PERFORMANCE

The year under review was characterised by a strong trading

performance, albeit in a challenging business environment.

This was backed by a strong management team and

staff complement, and supported by synergies extracted

from acquisitions.

Despite the reduction in revenue, and ultimately profit